Indian Textile sector: stress ahead

Indian Textile Industry is experiencing a period of stress. A dark cloud of decline is slowly enveloping the textile value chain right from spinning segment onwards. H1’23 experienced decline in demand in key international markets along with a slowing domestic market, topped with increasing competition from other Asian manufacturer suppliers. Receding demand in the US and EU markets have...

PLI in India

Performance Linked Incentives (PLI), the alchemy designed to boost domestic manufacturing by India has shown results though tepid. PLI has been structured to support 14 sector, and there are positive outcomes across 8 of these sectors. PLI disbursement in the remaining 6 is yet to begin. Of the 8 where there has been a positive impact of PLI the disbursement has been around $350mn which...

India Capital Market’s upbeat

Indian capital markets are kissing all time highs with flying FPI inflows and a stronger domestic investment climate. State Governments are being supported to invest on capital pipeline building infrastructures.But, how does this look across the sectors?A peek in to the sectoral dispersion indicates, it is largely the services that have driven the overall attractiveness along with some degree...

Crude Oil Challenge for India

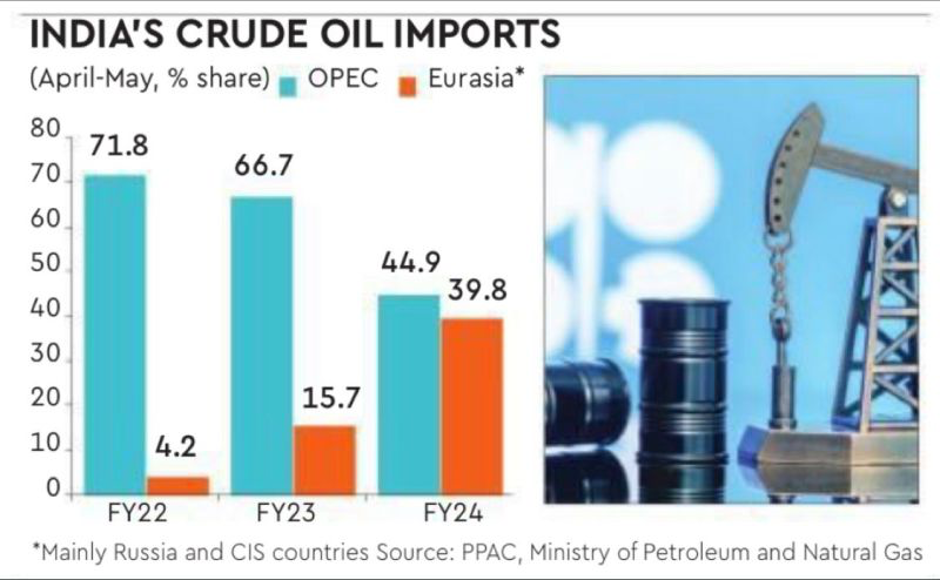

India has helped keep the global crude market sane. A more than 40% share of Russian crude in India’s energy basket might appear as a massive concentration of eggs in one basket. But this strategy has assisted in cooling the inflationary headwinds the economy faced. Reliance on Russian crude has infact helped India diversify meaningfully and lowering reliance on OPEC.An alternate view...

Misplaced valuation for new age technology businesses

Swiggy reported loses increasing by 80% in 2022. This set my mind racing since I notice similar news frequently. Now I want to give you a perspective on valuation. And for that I want you to walk backwards, almost 80 years in to history.Historically the first generation of businesses created value for itself by processing primary resources. Be it crude, cement, steel and the likes, all of...

An alternate to EV

Global EV adoption has been increased by over 60% in FY23. Outside of Southeast Asia and India where ICE continued to have traction along with EV, most global markets showed contracting market for ICE. EV now is a proven attractive case. A declining cost of battery packs will further push EV adoption. As with most other areas, China continues to be market as well as the largest exporter of...

Global Semiconductor markets

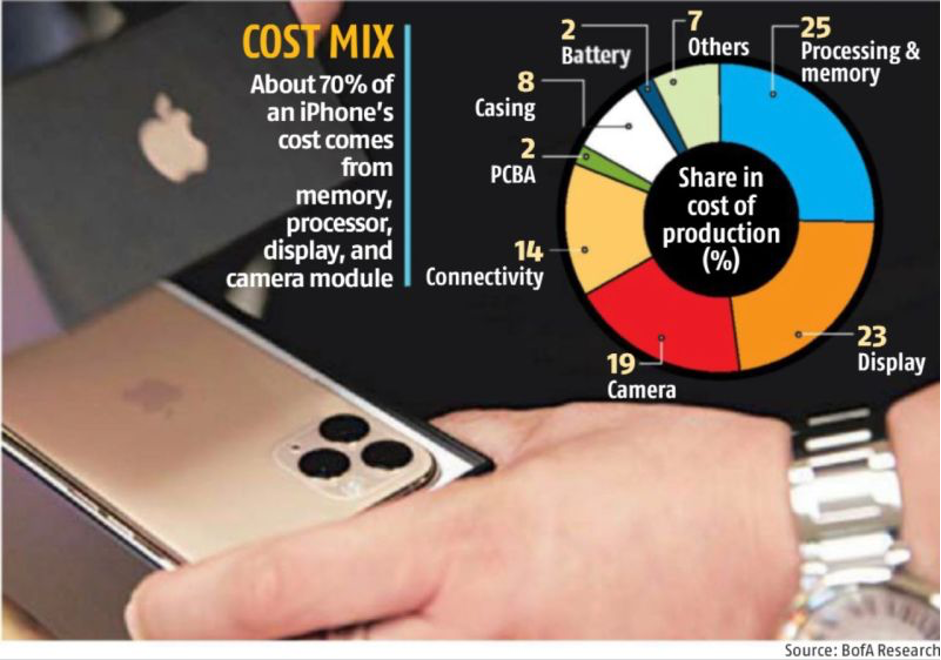

Globally semiconductor is expected to become a $1tn industry by 2030 from $600bn billion in 2021. The race to capture the market share both for regions to attract investments and for business houses to expand their existing capacities has seen an increased frenzy.AMD, Nvidia, Samsung and Intel have continued to strategise on what makes an apt sense considering multiple incentive scheme...

Europe’s race to EV loses torque to US

The future of European auto manufacturing is at stake with German companies like Mercedes-Benz, BMW and Volkswagen losing market share in China to local manufacturers like BYD. Chinese automakers are also selling cars under the British brand MG, SAIC who have cornered 5 percent of the European electric vehicle market.Meanwhile, European carmakers are hustling to build EV supply chains. But...

Energy Security for India

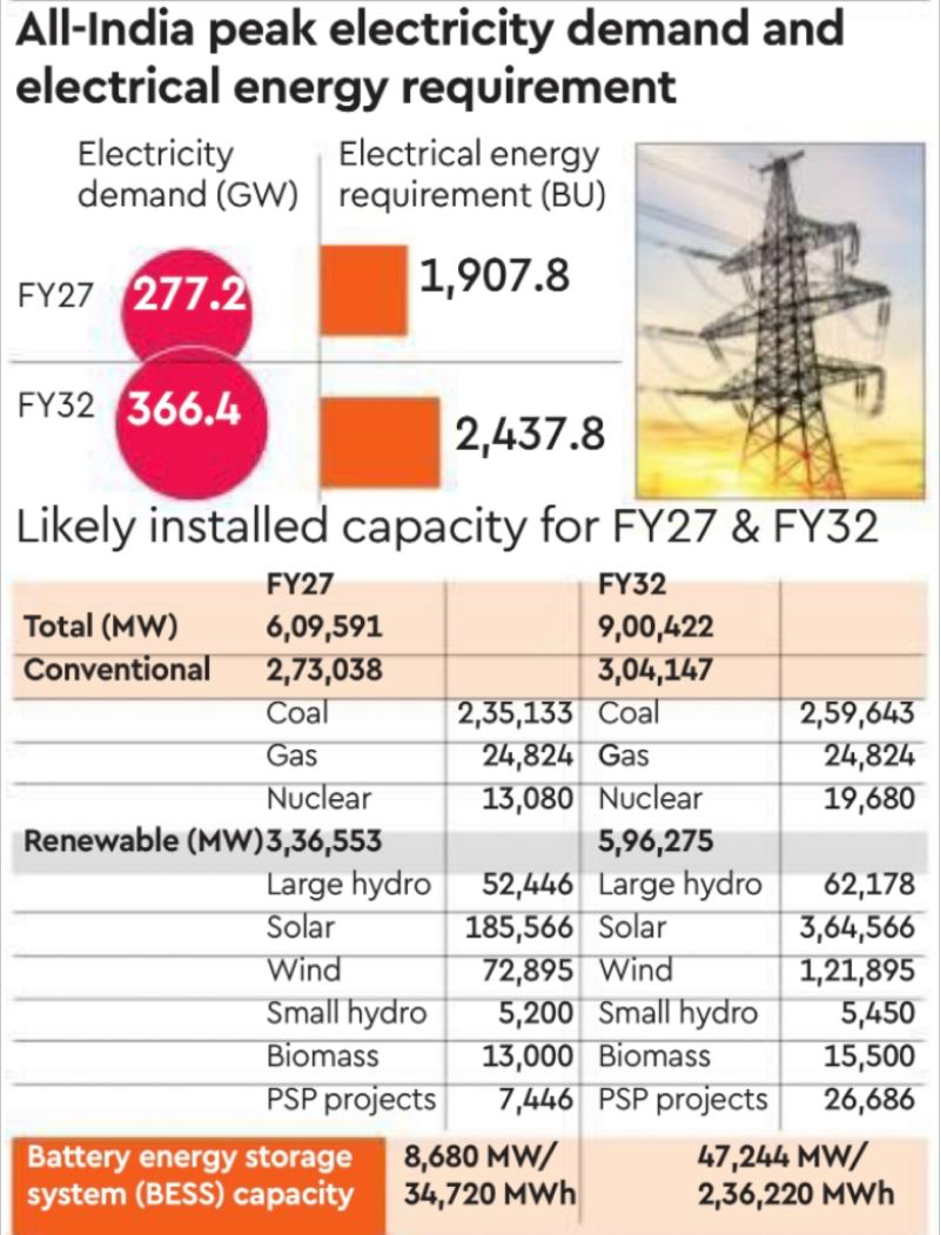

Affordable energy security shall remain key for India, now that there is a push towards enhancing merchandise output/ exportsIndia plans to increase the proportion of renewable capacity in the overall energy capacity mix from 42% now to 70% over the next 10 years. Though clean, Gas does not work out to be an affordable energy source and hence the expectation from gas fired plants is projected...

How simple is it to replace China as a global manufacturing hub.

For a very long time the world has tremendously benefited from China’s emergence as a manufacturing hub. It has been commented by many that China has exported deflation for a long time to the world. Trade relations with China has helped the world access lower cost manufacturing which cannot be replicated at a scale and economics, delivered by China.Today China accounts for 31% of the global...